February 6, 2026

What is Retrospective Taxation?

Why in News ? In Union Budget 2026-27, a significant tax “googly” emerged regarding Sovereign Gold Bonds (SGBs). While the budget was initially praised for its stability, the fine print revealed a major change in how capital gains on these bonds are taxed, causing concern among investors.

The news centers on a major policy shift: the removal of the blanket tax exemption on SGB maturity proceeds.

- The Change: Previously, any individual holding SGBs until maturity (8 years) paid zero capital gains tax, regardless of whether they bought the bonds directly from the RBI or from the stock market (secondary market).

- The “Googly”: Starting April 1, 2026, the exemption will be restricted only to original subscribers who buy the bonds during the initial issue and hold them until maturity.

- Market Impact: SGB prices in the secondary market fell by up to 10% immediately after the announcement as investors factored in the new tax liability.

Crucial Distinction: If you bought SGBs on the stock exchange to save on tax at maturity, that benefit is now gone. You will now be taxed on the profit (Redemption Price minus Purchase Price).

About Retrospective Taxation

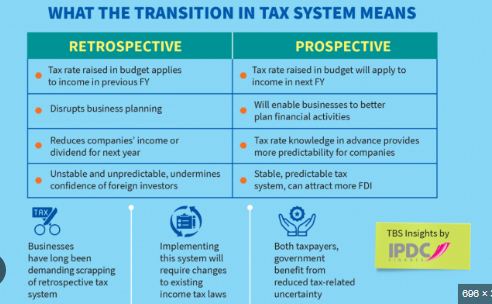

The article refers to this as a “retrospective tax” because it changes the rules for bonds that were already issued and bought years ago.

- Definition: A retrospective tax allows a government to pass a law that taxes transactions or income from a date in the past, essentially changing the tax liability after the deal is done.

- The Argument: Investors argue that when they bought SGBs in 2018 or 2020, the “contract” with the state was that maturity would be tax-free. By changing the rule in 2026 for bonds maturing in 2028, the government is perceived as going back on its word.

- Government View: The government labels this a “clarification” to align the tax benefit with the original intent: rewarding long-term “original” savers rather than traders.

Key Points of the New SGB Tax Rule:

| Feature | New Rule (Effective April 2026) |

| Original Subscribers | Tax-Free at maturity (if held continuously). |

| Secondary Market Buyers | Taxable at 12.5% (LTCG) even if held until maturity. |

| Premature Exit | Taxable (as per existing LTCG/STCG rules). |

| Annual Interest (2.5%) | Taxable as per your income slab (no change). |

| Tax Rate | 12.5% (Long-term) without indexation. |

Types of Capital Gains Tax in India:

Under the New Income Tax Act 2025/26, most assets are categorized as follows:

- LTCG (Long-Term Capital Gains): Applied when assets are held for more than a specific period (24 months for SGBs). Now taxed at a flat 5%.

- STCG (Short-Term Capital Gains): Applied when assets are sold quickly. These are usually added to your total income and taxed at your applicable slab rate.

October 17, 2025

October 16, 2025

October 6, 2025

September 24, 2025