February 7, 2026

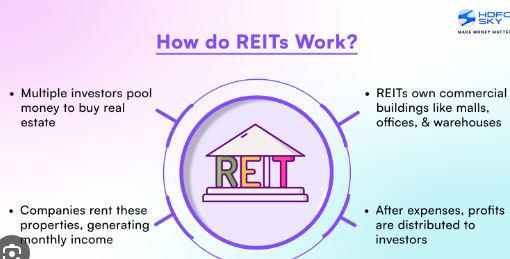

REITs

Why in news ? The RBI recently decided to allow banks to lend directly to RIETs ,While this helps the real estate sector get cheaper money, it comes with significant risks.

The Big Change:

- Old Policy: Banks kept a “safe distance” from real estate to avoid financial crashes. REITs were meant to take real estate risks out of banks and give them to stock market investors.

- New Policy: Banks can now lend directly to REITs.

The Problem: This “re-imports” the risk back into the banking system. If the real estate market crashes, the banks crash too.

Why is this risky?

- Systemic Risk: Since there are only a few large REITs, many banks will lend to the same few companies. A single failure could hurt the entire banking industry.

- Asset-Liability Mismatch: Banks use short-term deposits to give long-term loans. Real estate takes a long time to pay back and is hard to sell quickly.

- Interest Rate Trouble: If the RBI raises interest rates, REITs have to pay more for their loans while their property values go down—a “double hit.”

- “Crowding Out”: Banks might prefer lending to big, shiny commercial buildings (REITs) rather than helping farmers or small businesses (MSMEs).

- Work-from-Home Risk: Unlike roads or power plants, offices depend on companies renting them. If more people work from home, REITs lose money and can’t pay back the banks.

RBI’s Safety Rules (Prudential Constraints):

To prevent a disaster, the RBI is adding “locks”:

- Limits (Caps): Banks can only lend a small percentage of their money to any one REIT.

- No Speculation: The money must be used to buy real buildings, not for gambling on empty land.

- Strict Oversight: Banks can only lend to REITs that are listed on the stock market and monitored by SEBI.

Gist of daily Article /The Hindu 17oct 2025

October 17, 2025

Daily Gist of the Hindu/Indian Express : 16 Oct 2025

October 16, 2025

Daily Gist of The Hindu/Indian Express: 6 Oct 2025

October 6, 2025

Daily Gist of Article /The Hindu /Indian Express: 24 Sep 2025

September 24, 2025