August 26, 2025

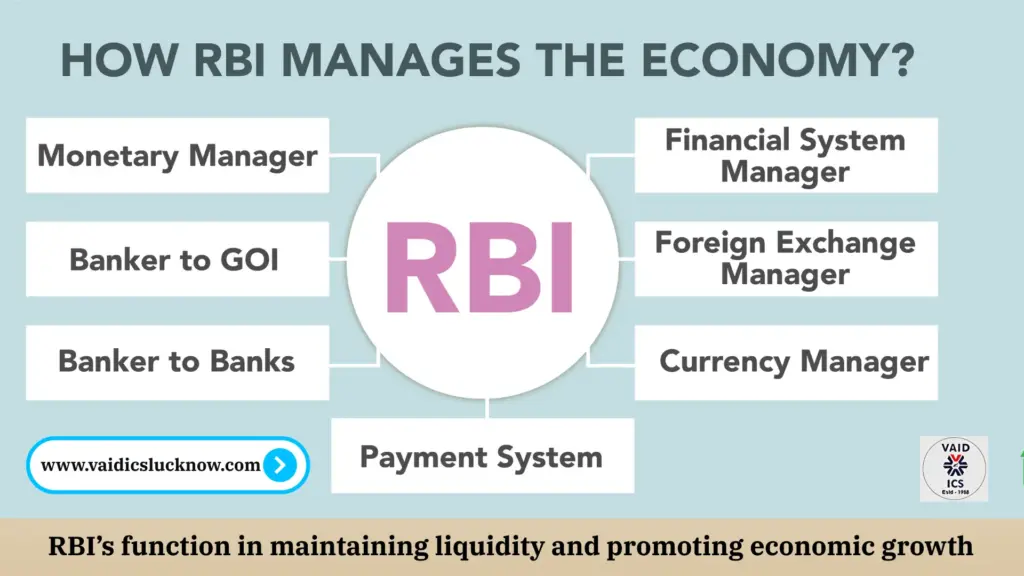

RBI’s function in maintaining liquidity and promoting economic growth

Why in the News?

- Malhotra noted that RBI Governor Shakti anta Das spoke at the annual banking conclave organized by FICCI and IBA.

- He highlighted RBI’s role in ensuring liquidity and supporting economic growth at a time when:

- Loan growth has fallen to its lowest level since March 2022.

- Private sector investment remains sluggish.

- Global trade tensions (like U.S. tariff hikes on Indian imports) are adding pressure.

RBI’s Role in Economic Growth (Present Context)

Ensuring Liquidity in Banking System

- RBI has maintained ample liquidity to ensure industries (MSME, textiles, footwear, etc.) get credit.

- Loans to industries grew 5.49% (weakest since 2022), showing a slowdown.

Supporting Affected Sectors

- RBI is focusing on sectors that are severely impacted by global conditions and weak demand.

Policy Reforms for Growth

- Reduced repo rate by 200 basis points (bps) to encourage cheaper borrowing.

- Ensuring credit flow to exporters and labor-intensive industries.

Encouraging Investment Cycle

- Called on private companies and corporates to invest confidently and help revive the economy’s momentum.

Tariff Issue (US Tariffs on Indian Goods):

- Background:

- US President Trump announced up to 50% tariffs on imports from India (especially steel, aluminum, and defence-related items).

- Key worry: this may reduce India’s exports and slow GDP growth by about 0.6 percentage points.

- Impact on India:

- RBI expects ‘minimal impact’ if negotiations succeed.

- Export sectors like textiles, footwear, labor-intensive goods could be worst affected.

Steps Taken by RBI to Counter Tariff & Growth Challenges

- Monetary Easing: Repo rate cut by 200 bps.

- Liquidity Support: Ensured banks have enough liquidity to lend.

- Targeted Sectoral Support: Focus on MSME, exporters, labor-intensive industries.

Confidence Building: Urging the private sector to revive investment despite global headwinds.

GIST OF DAILY ARTICLES THE HINDU/INDIAN EXPRESS : 4 sep 2025

September 4, 2025

Gist of Daily News Papers Articles/The Hindu /Indian Express-1 Sep 2025

September 1, 2025

GIST OF DAILY ARTICLES THE HINDU/INDIAN EXPRESS/27 August 2025

August 27, 2025