February 16, 2026

Permanent Framework for State Reorganisation

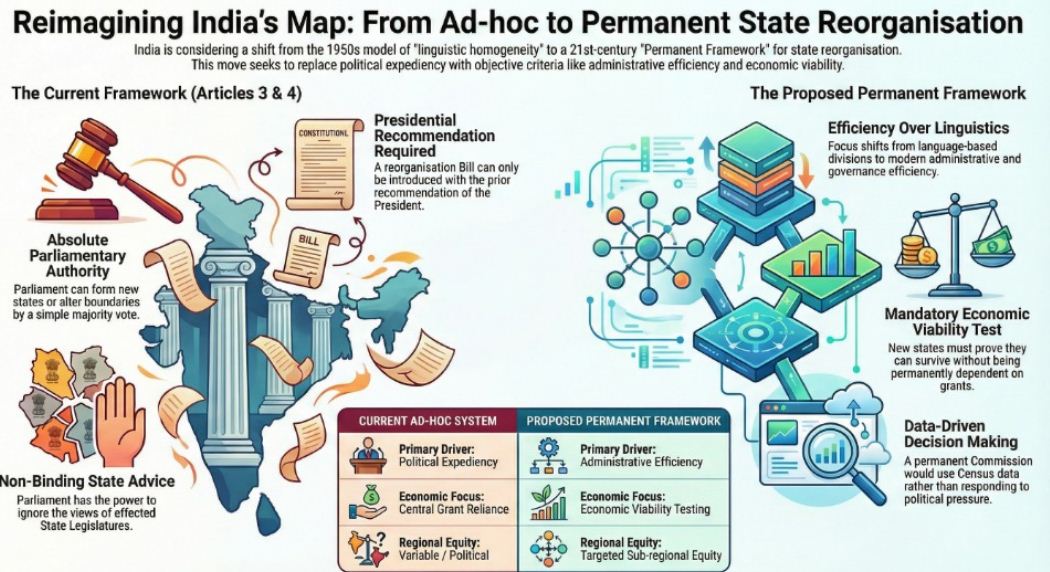

Why in News ? A recent Private Member’s Bill introduced in Parliament proposes shifting from the current ad-hoc method of creating states to a Permanent Framework. This seeks to move the conversation from 1950s “linguistic homogeneity” to 21st-century “administrative efficiency.”

The Existing Constitutional Framework:

The current process is governed primarily by Articles 3 and 4 of the Indian Constitution:

- Parliamentary Authority: Parliament can form new states, alter areas, or change names by a simple majority.

- Presidential Recommendation: A reorganisation Bill can only be introduced with the prior recommendation of the President.

- State Role (Advisory): Before the recommendation, the President refers the Bill to the affected State Legislature. However, their views are non-binding; Parliament can ignore the state’s opinion.

Rationale For a Permanent Framework:

Proponents argue that a permanent system would bring objectivity to a process often driven by political expediency.

| Key Driver | Description |

| Paradigm Shift | Moves the focus from language to Administrative Efficiency. |

| Institutional Reform | Establishes a permanent ‘States & UTs Reorganisation Commission’ to use Census data rather than political pressure. |

| Fiscal Prudence | Introduces a mandatory “Economic Viability Test” to ensure new states aren’t permanently dependent on Central grants. |

| Sub-regional Equity | Empowers neglected regions (e.g., Vidarbha, Bundelkhand) to end “internal colonialism” and resource drain. |

| Democratic Safety | Provides a legal channel for regional aspirations, potentially reducing violent secessionist movements. |

Rationale Against a Permanent Framework:

Critics worry that making the process “permanent” or “easier” could destabilize the Union.

- Balkanisation Risk: An open-door policy could trigger a “domino effect,” where every distinct district (e.g., Bodoland, Gorkhaland) demands statehood, threatening national unity.

- Inter-State Strain: New borders can intensify river-water disputes and fragment resources needed for large-scale infrastructure.

- Constitutional Conflict: If a statutory body’s findings were made binding, it would directly conflict with Article 3, which grants discretionary power to Parliament.

- Technocratic Limitations: A “scientific index” cannot easily measure or satisfy deep-seated emotional and cultural sentiments.

- Federal Friction: Opposition-ruled states might view a Central Commission as a tool to weaken or destabilize them, harming Cooperative Federalism.

The Way Forward:

To address regional grievances without compromising national integrity, the following strategies are proposed:

A. Structural & Legal Review

- Second States Reorganisation Commission: Conduct a one-time, scientific review of the map based on administrative needs.

- Amend Article 3: Consider making the State Legislature’s consent mandatory (or weightier) to protect federal principles.

B. Alternative Governance Models

- Special Development Boards: Use Article 371 to address regional imbalances without full statehood.

- Autonomous Councils: Grant greater local autonomy to satisfy ethnic or sub-regional identities.

C. Strengthening Institutions

- Inter-State Council (Article 263): Use this platform for dialogue to resolve disputes before they escalate into demands for separation.

- Strict Benchmarks: Establish “Fiscal Self-Reliance” and “Administrative Convenience” as non-negotiable prerequisites for any new state.

About Economic Viability Test:

Economic Viability Test is a formal assessment used to determine if a proposed new state can survive and thrive financially on its own, without being a permanent burden on the Central Government.

Key Components of the Test:

To pass this “test,” a proposed state must demonstrate strength in several financial areas:

- Revenue Generation (Internal Resources):

Does the region have enough industries, agriculture, or services to generate its own tax revenue (GST, excise, property taxes)?

- Debt-to-GSDP Ratio:

A calculation of whether the new state’s debt will be manageable relative to its Gross State Domestic Product (GSDP).

- Capital vs. Revenue Expenditure:

Can the state afford its “running costs” (salaries, pensions, electricity) while still having money left over for “capital assets” (building roads, hospitals, and schools)?

- Infrastructure Readiness:

Does the region already have a functional capital city, high courts, and administrative headquarters, or will the Center have to spend billions to build them from scratch?

- Natural Resource Ownership:

An analysis of who gets the mines, rivers, and forests. If a new state gets the minerals but the old state keeps the processing plants, the economic viability of both is threatened.

Why is this “Test” being proposed?

Currently, India does not have a strict, legal “Economic Viability Test.” States are often created based on political or identity-based demands.

- The Problem: Some newer states have struggled with massive deficits. For example, when Telangana was created, it took the high-revenue hub of Hyderabad, leaving the “residuary” state of Andhra Pradesh with a significant financial gap.

- The Goal: The Permanent Framework mentioned in your notes suggests making this test a non-negotiable precondition. This prevents “Internal Colonialism,” where a wealthy sub-region is drained to support a whole state, but also prevents “Fiscal Parasitism,” where a new state relies entirely on Central grants to survive.

Comparison: Ad-hoc vs. Viability Test

| Feature | Current “Ad-hoc” Method | Proposed “Viability Test” |

| Primary Trigger | Political protests / Language | Data-driven financial audits |

| Sustainability | Often ignored until after the split | Must be proven before the split |

| Central Grants | Heavily dependent on “Special Status” | Aimed at “Fiscal Self-Reliance” |

October 17, 2025

October 16, 2025

October 6, 2025

September 24, 2025