September 8, 2025

Inverted Duty Structure (IDS): 5 Major GST Industry Issues

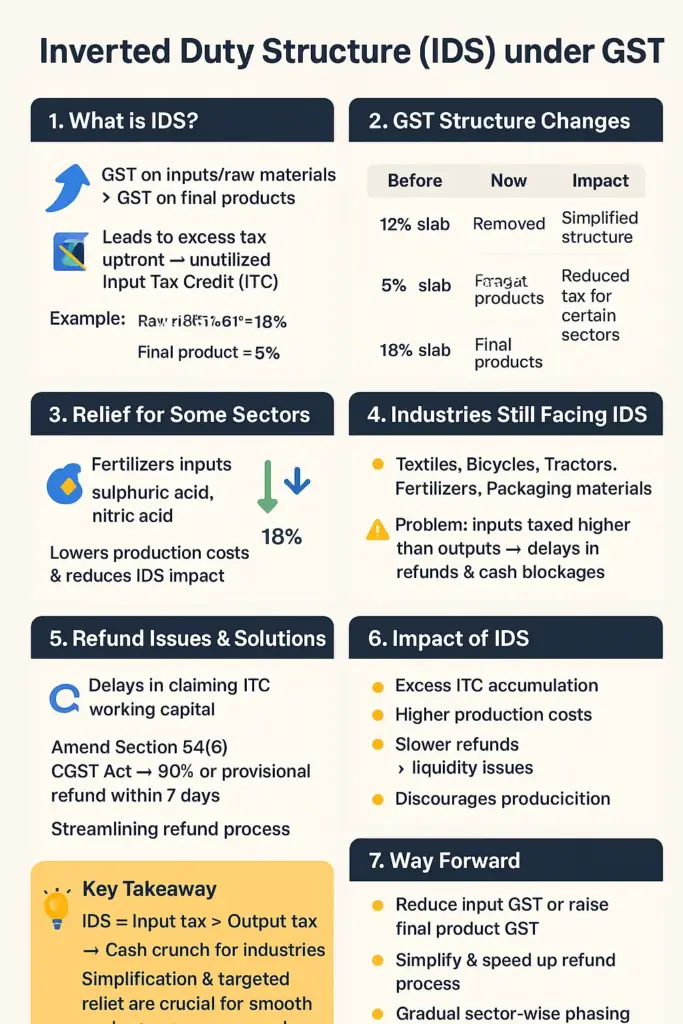

The inverted duty structure (IDS)

The inverted duty structure (IDS) under GST has been a long-standing issue for several industries like textiles, bicycles, tractors, and fertilizers.

- Recently, the GST Council reduced rates on certain inputs to address the inversion problem, bringing some relief.

- However, gaps still remain, particularly for sectors where input tax rates are higher than output tax rates, leading to working capital blockages and refund-related issues.

- The Council is also working on legal amendments to streamline the refund process and reduce cash flow problems for industries.

Key Points: The inverted duty structure (IDS)

GST Structure Change:

GST now has a two-slab structure:

- 5% slab – for essential goods and raw materials.

- 18% slab – for final products.

Earlier, there was a 12% slab, which has now been removed.

Relief for Some Sectors:

- Reduction in GST rates for certain fertilizer inputs like sulphuric acid, nitric acid, and ammonia from 18% to 5%.

- This is expected to lower production costs for fertilizers.

Industries Still Facing Inversion:

Textiles, bicycles, tractors, fertilizers, and certain packaging materials are still facing IDS problems.

Example:

- Raw materials taxed at 18%.

- Final product taxed at 5%.

- This leads to discrepancies in tax rates and difficulties in processing refunds.

Refund Issues:

- Industries face delays and cash blockages due to complex refund procedures.

GST Council has proposed:

- Amending Section 54(6) of the CGST Act to allow 90% of the provisional refund to be issued within seven days.

- Streamlining refund mechanisms to prevent working capital shortages.

Concerns for Industries:

- High tax rates on inputs discourage production.

- Difficulty in claiming refunds adds to financial stress.

- Industries seek a streamlined and effective refund process to prevent funds from being tied up.

About Input-Output GST (Inverted Duty Structure):

An Inverted Duty Structure (IDS) occurs when the GST levied on inputs is higher than that applied to the final product.

- This causes businesses to pay more tax upfront, leading to unutilized Input Tax Credit (ITC).

Example:

- GST on raw material (input) = 18%

- GST on finished product (output) = 5%

- The company pays 18% initially, but only collects 5% from customers, creating an imbalance.

Impact:

- Excess ITC accumulation.

- Increased working capital requirement.

- Higher production costs.

- Slower refunds affecting business liquidity.

Way Forward:

- Reduce input GST rates or increase final product GST rates to balance tax rates.

- Simplify and speed up refund processes.

- Gradual phasing out of IDS by revising GST rates sector-wise.

- Digital solutions for real-time refund tracking to support industries.

September 8, 2025

September 4, 2025

September 1, 2025

August 27, 2025