December 30, 2025

Gross Non-Performing Assets (GNPA)

Why in news?

The decline in India’s banking sector Gross Non-Performing Assets (GNPA) ratio to 2.1% as of September 2025 (from 2.2% in March 2025 and 2.7% in March 2024) marks a multi-decadal low, as highlighted in the RBI’s “Report on Trend and Progress of Banking in India 2024-25” released on December 29, 2025. This is major positive news for the Indian economy because:

- It signals a healthier banking system with fewer bad loans, improving banks’ ability to lend more freely.

- Strong asset quality supports sustained economic growth by enabling credit flow to businesses and individuals.

- It reflects resilience amid global challenges, with banks maintaining high capital buffers (CRAR at 17.2%) and robust profitability (RoA ~1.4%).

- Net NPA is at just 0.5%, showing effective provisioning against potential losses.

- This cleanup strengthens investor confidence in Indian banks and the broader financial system.

Key Points from the Report:

Current GNPA Levels

- Gross NPA Ratio: 2.1% (end-September 2025) – lowest in decades.

- Net NPA Ratio: 0.5% (unchanged from March 2025).

- Absolute Gross NPAs: Reduced to ~Rs 4.32 lakh crore (from Rs 4.81 lakh crore a year earlier).

Historical Trend (as shown in the image)

The GNPA ratio has steadily declined since peaking:

- 2017-18: 11.2%

- 2018-19: 9.1%

- 2019-20: 8.2%

- 2020-21: 7.3%

- 2021-22: 5.8%

- 2022-23: 3.9%

- 2023-24: 2.7%

- 2024-25 (March): 2.2%

- 2025 (September): 2.1%

This is the lowest since before 2011 (when it was around 2-3%).

Main Reasons for the Decline:

- High Recoveries and Upgradations: Accounted for ~42.8% of GNPA reduction in 2024-25.

- Write-offs: Major contributor (e.g., Rs 1.58 lakh crore in reductions).

- Lower Fresh Slippages: Slippage ratio fell for the fifth straight year to 1.4% (new bad loans as % of standard advances).

- Better Credit Underwriting and Monitoring: Improved risk assessment and early stress resolution.

- Decline in Special Mention Accounts (SMA-0 and SMA-2): Early warning indicators of stress reduced, especially for large borrowers.

- Regulatory and Policy Support: Ongoing effects of measures like Insolvency and Bankruptcy Code (IBC), SARFAESI Act, and specialized stressed asset management in banks.

What is NPA?

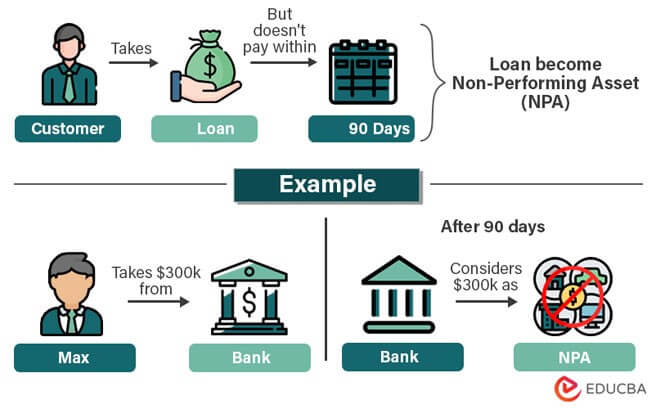

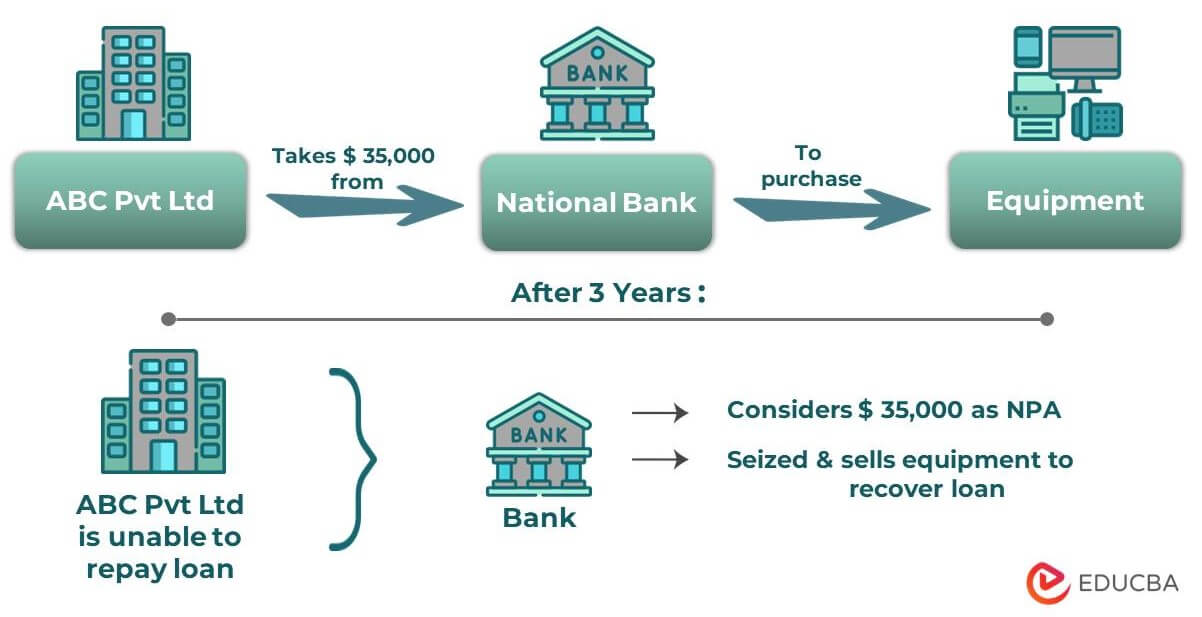

NPA stands for Non-Performing Asset. In banking (especially in India), it refers to a loan or advance where the borrower has failed to make interest or principal payments for more than 90 days.

According to the Reserve Bank of India (RBI):

- An asset becomes non-performing when it ceases to generate income for the bank.

- This 90-day overdue norm has been in place since 2004 to align with global standards.

In simple terms: Banks earn money from the interest on loans. If a borrower stops paying for over 90 days, the loan stops “performing” (earning income) and is classified as an NPA – a “bad loan”.

Types (Classification) of NPAs

NPAs are further categorized based on how long they have been non-performing and the likelihood of recovery:

- Substandard Assets: NPA for ≤ 12 months.

- Doubtful Assets: NPA for > 12 months.

- Loss Assets: Identified as unrecoverable by the bank/auditor/RBI, but some salvage value may exist.

.webp)

Key Metrics

Key Steps Taken to Reduce NPAs in Indian Banks:

The Indian government and RBI have implemented a multi-pronged approach under strategies like the 4R’s (Recognition, Resolution, Recapitalization, Reforms) to tackle NPAs. Major measures include:

- Insolvency and Bankruptcy Code (IBC), 2016: Revolutionized resolution by shifting control from defaulting promoters, enabling time-bound insolvency proceedings, and debarring wilful defaulters from bidding or accessing markets.

- SARFAESI Act, 2002 (with amendments): Allows banks to enforce security interest without court intervention, facilitating faster recovery through asset possession and sale (e.g., via e-auctions).

- Asset Quality Review (AQR), 2015: Forced transparent recognition of stressed assets, ending evergreening practices and leading to full provisioning.

- Prudential Framework for Resolution of Stressed Assets (2019): Mandates early recognition, time-bound resolution plans, and incentives for quick action.

- Recapitalization of Public Sector Banks (PSBs): Government infused capital to strengthen balance sheets, enabling better lending and recovery.

- Central Repository of Information on Large Credits (CRILC): Monitors large exposures (>Rs 5 crore) for early stress detection.

- Write-offs, Recoveries, and Upgradations: Significant reductions via high recoveries (e.g., ~42.8% of GNPA decline in 2024-25 from recoveries/upgradations) and write-offs.

- Other Initiatives: Formation of Asset Reconstruction Companies (ARCs), Debt Recovery Tribunals (DRTs), restrictions on wilful defaulters, and enhanced monitoring of Special Mention Accounts (SMA-0/1/2) as early warning signals.

These efforts have driven GNPA down to a multi-decadal low of 2.1% (September 2025).

Ongoing Challenges in Reducing NPAs:

Despite progress, several hurdles persist in fully eradicating NPAs:

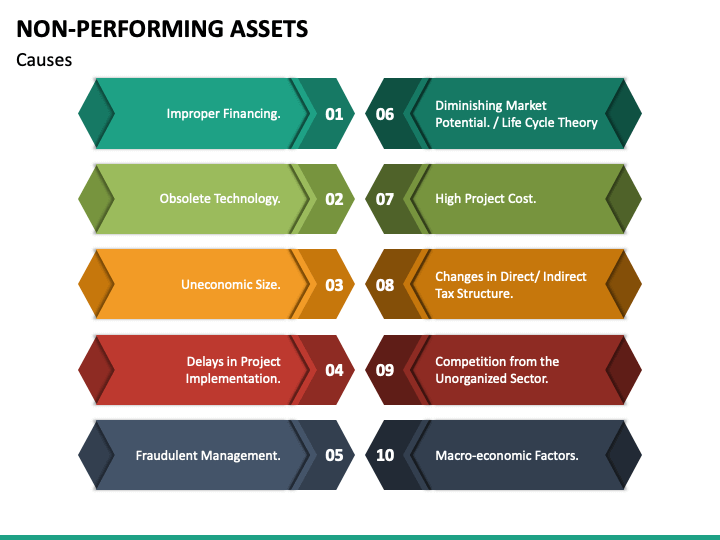

- Economic and Sectoral Stress: Slowdowns, project delays in infrastructure/power/steel, and borrower over-leverage lead to fresh slippages, especially in segments like microfinance (GNPA rose to 4.1% in some NBFC-MFIs) and consumer durables.

- Wilful Defaults and Frauds: Increasing fraud cases (e.g., 18,461 in H1 2024-25) and borrower non-cooperation complicate recoveries.

- High Haircuts in Resolutions: Creditors often recover only a fraction under IBC, reducing incentives.

- Judicial and Operational Delays: Pending cases in courts/DRTs slow enforcement, despite mechanisms like IBC.

- Risk Management Gaps: Weak credit appraisal, governance issues in PSBs, and aggressive past lending practices contribute to new NPAs.

- Emerging Risks: Rising unsecured retail loans, cyber threats, climate-related stresses, and competition from non-banks for funds/mobilization.

- Microfinance and Retail Strains: Over-indebtedness in certain borrower segments leads to higher delinquencies.

October 17, 2025

October 16, 2025

October 6, 2025

September 24, 2025