November 7, 2025

Daily Current Affairs for UPSC : 7 Nov , 2025/What is Central Revenue Audit (CRA) Cadre:

Central Revenue Audit (CRA) & CEA Cadres:

Why in News ? The Comptroller and Auditor General (CAG) of India has granted in-principle approval for the creation of two new specialised cadres within the Indian Audit and Accounts Department (IA&AD). These cadres are part of a major reform initiative aimed at improving centralisation and enhancing audit quality.

What is Central Revenue Audit (CRA) Cadre:

The Central Revenue Audit (CRA) Cadre will focus exclusively on auditing Central Government revenues.

- The formation of this cadre aims to develop deeper domain expertise in revenue audits.

- Centralisation of audit functions will ensure consistency, efficiency, and improved quality in auditing the government’s revenue streams.

About Central Expenditure Audit (CEA) Cadre:

The Central Expenditure Audit (CEA) Cadre will specialise in auditing the expenditure of the Central Government.

- The CEA cadre will enable auditors to gain professional specialisation in expenditure-related processes and financial management.

- This specialisation is expected to further improve the quality and accuracy of expenditure audits.

Objective and Implementation:

According to the CAG’s press statement,

- “This reform, which will come into effect from 1st January 2026, aims to build deeper professional expertise and further improve the quality of audit of Central Government finances.”

- Currently, audits of Central receipts and expenditure are performed by multiple offices with dispersed cadre control across various State Civil Audit offices. This leads to fragmentation and inefficiencies.

Key Benefits of the Reform:

- Centralisation of audit operations for better coordination.

- Specialisation leading to enhanced professional competence.

- Improved manpower management, with more flexible deployment.

- Consolidation of 4,000 audit professionals (out of the total CAG strength of 42,000) under these two new cadres.

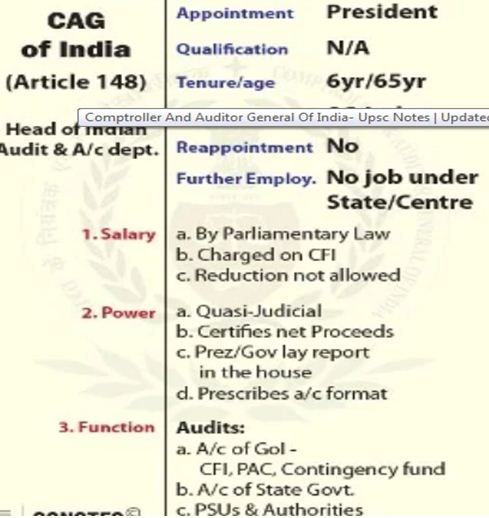

About CAG:

Importance of the Office:

Constitutional and Legal Provisions

Duties and Powers of the CAG:· Audits all expenditure from the Consolidated Fund, Contingency Fund, and Public Account of India and States. · Audits receipts and revenues to ensure proper collection and allocation. · Audits trading, manufacturing, and profit and loss accounts of government departments.

|

October 17, 2025

October 16, 2025

October 6, 2025

September 24, 2025