August 27, 2025

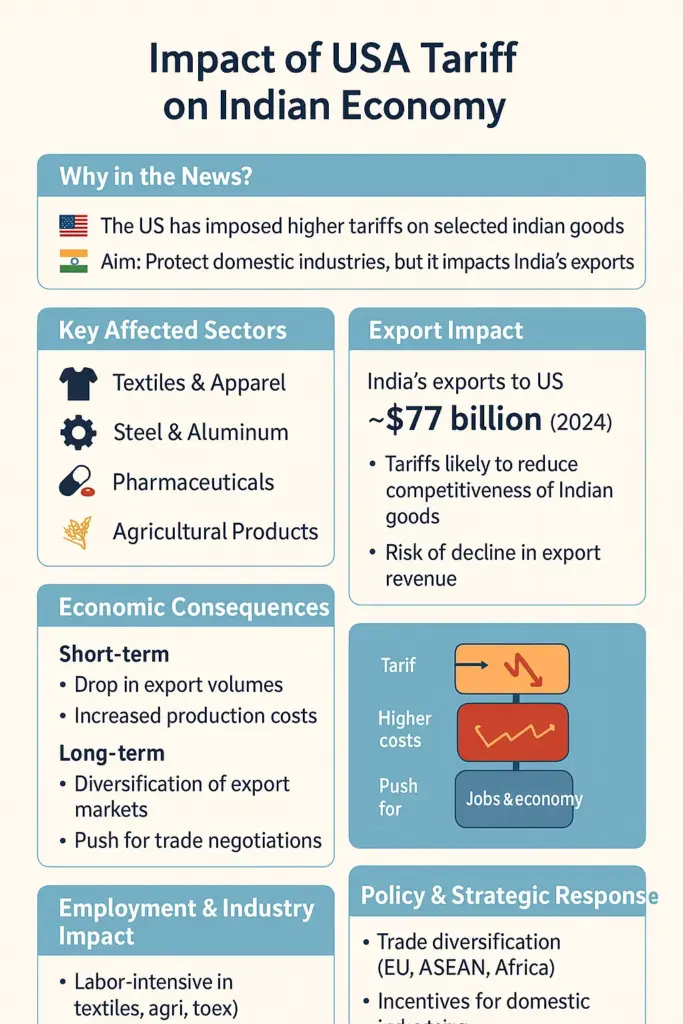

Impact of USA Tariff on Indian Economy

Why in the News?

The U.S. government is set to implement an additional 25% tariff on Indian goods starting August 27, 2025, following President Donald Trump’s executive order.

- This comes on top of the existing 25% tariffs since August 7, making a total of 50% duty on many Indian exports.

- Tariffs are being imposed partly as a penalty for India’s continued import of Russian oil.

- India has described these sanctions as “unfair, unwarranted, and unreasonable.”

Key Points: Impact of USA Tariff on Indian Economy

Tariff Details:

- 50% effective tariff on $47-48 billion worth of Indian exports.

- Exemptions: Iron, steel, aluminum, passenger vehicles, copper products.

- Tariffs effective for U.S.-bound shipments after Aug 27, 2025.

Reactions:

- Indian Government: Pushing “Vocal for Local” to reduce reliance on U.S. markets.

- China: Called the U.S. a “bully” and expressed support for India.

- RBI: Promised support to adversely affected sectors.

- Exporters’ View: Expect major competitiveness loss against China, Vietnam, Philippines, etc.

Domestic Response:

- GST Council to meet (Sept 3–4, 2025) for rate cuts and rationalization to boost domestic consumption.

Impact of Tariffs on Indian Economy:

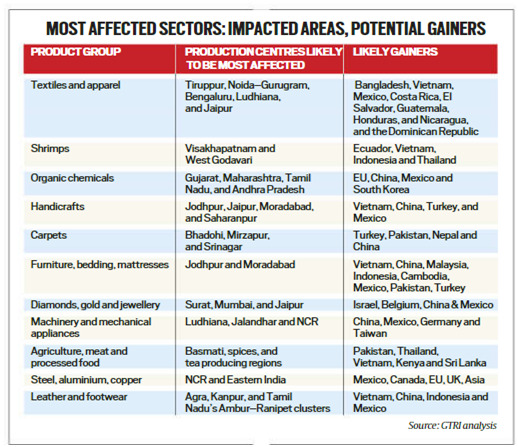

Export Sector Hit:

- Indian exports valued at approximately $47–48 billion, accounting for 55% of shipments to the U.S., encounter a 30–35% pricing disadvantage.

- Likely to hurt textiles, pharmaceuticals, IT hardware, machinery, and consumer goods.

Balance of Payments Stress:

- India’s trade surplus with the U.S. may shrink.

- Forex inflows could reduce, pressurizing rupee.

GDP Growth Impact:

- Exports being a growth driver, tariffs may slow down overall growth.

- Some sectors may face layoffs and reduced production.

Inflationary Concerns:

- U.S. tariffs may reduce India’s competitiveness → lower demand for Indian goods → domestic over-supply could depress prices in some sectors.

- But higher import substitution efforts may push domestic inflation in the medium term.

Options Before India & Steps needed:

Diplomatic Measures:

- Engage in bilateral negotiations with the U.S. to roll back or reduce tariffs.

- Explore options under WTO’s Dispute Settlement Body (though time-consuming).

- Use support from China and other affected countries to build pressure on U.S. in multilateral forums.

Economic/Trade Diversification:

- Reduce over-dependence on the U.S. market by boosting exports to EU, ASEAN, Middle East, Africa.

- Encourage South-South cooperation and expand trade with BRICS members.

Domestic Policy Response:

- GST rationalization to cut production costs.

- Provide export subsidies, credit support, and insurance to affected sectors.

- Expand PLI (Production Linked Incentive) schemes to make Indian products more competitive.

Strategic Shift:

- Boost domestic industries by advancing the ‘Self-Reliant India’ and ‘Support Local’ initiatives.

- Push for regional trade agreements (RCEP reconsideration, IPEF engagement, FTAs with UK & EU)

GIST OF DAILY ARTICLES THE HINDU/INDIAN EXPRESS/27 August 2025

August 27, 2025

Daily The Hindu Article Gist : 25 August 2025/ Jan Vishwas 2.0

August 25, 2025

Solved Paper UPSC MAINS -2025 GS PAPER-1 / Model Answer

August 23, 2025

UPSC MAINS 2025 GS PAPER 1 HELD ON 23 AUGUST 2025

August 23, 2025