April 29, 2025

Draft Greenhouse Gases Emissions Intensity (GEI) Target Rules, 2025

Why in News? The government has notified draft Rules introducing targets for the reduction of greenhouse gas (GHG) emissions by “obligated entities” in energy-intensive sectors and industries.

The Draft Greenhouse Gases Emissions Intensity (GEI) Target Rules, 2025, were notified by the Ministry of Environment, Forest and Climate Change (MoEFCC) on April 16, 2025. These rules establish a compliance mechanism for the Carbon Credit Trading Scheme (CCTS), 2023, which aims to reduce emissions in energy-intensive industries and support India’s commitments under the Paris Climate Agreement of 2015.

Relevance : Pre & Mains

Prelims– Gases Emissions Intensity (GEI)/ Carbon Credit Trading Scheme (CCTS), 2023

Mains- GS Paper III (Environment, Sustainable Development) and GS Paper II (Governance, International Relations)

What is meant by greenhouse gases emissions intensity (GEI)?

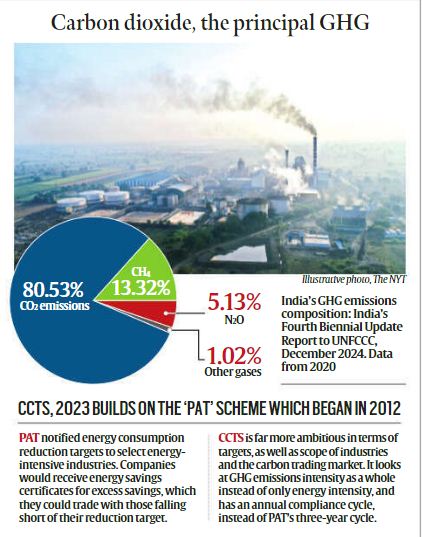

Greenhouse gases (GHGs) are gases that trap heat in the atmosphere, contributing to the greenhouse effect and raising Earth’s surface temperature. The five most abundant GHGs are water vapor, carbon dioxide (CO2), methane, nitrous oxide, and ozone, with others including synthetic fluorinated gases like chlorofluorocarbons (CFCs) and hydrochlorofluorocarbons (HCFCs).

GHG Emissions Intensity (GEI) measures the amount of GHGs emitted per unit of product output—for example, the GHGs released to produce 1 tonne of cement, aluminum, or paper. The draft rules define GEI as “greenhouse gases emission intensity in tCO2e/equivalent output or product,” where tCO2e (tonnes of carbon dioxide equivalent) is a standard unit to quantify the warming impact of all GHGs, not just CO2, based on their global warming potential.

So what do the draft GEI target Rules say?

- The rules set baseline emissions using 2023-24 data and establish gradual reduction targets for 2025-26 and 2026-27 to operationalize the CCTS 2023.

- These targets focus on four energy-intensive sectors: aluminum, chlor-alkali, pulp and paper, and cement, covering 282 industrial units (13 aluminum plants, 186 cement plants, 53 pulp and paper plants, and 30 chlor-alkali plants).

- Major companies like Vedanta, Hindalco, Bharat Aluminium, Ultratech, and JSW Cement are assigned specific targets. For instance, Vedanta’s Smelter II in Jharsuguda, Odisha, must reduce its GEI from 13.4927 tCO2e/tonne in 2023-24 to 13.2260 in 2025-26 and 12.8259 in 2026-27. The rules also outline compliance mechanisms and penalties for non-compliance, enforced by the Central Pollution Control Board (CPCB).

Why is it important to have the targets?

- These targets are critical for meeting India’s climate goals, particularly the Paris Agreement commitment to reduce the emissions intensity of its GDP by 45% by 2030 from 2005 levels. They push industries toward low-carbon growth by encouraging the adoption of cleaner technologies, such as replacing coal with biomass or using energy-efficient kilns in cement production. The broader objective is to promote sustainable, cutting-edge technologies in high-emission sectors to address climate change. While the GEI targets are new, they build on the Perform, Achieve, Trade (PAT) scheme, which has promoted energy efficiency since 2012.

And how do these draft Rules tie into India’s carbon credit trading scheme?

- The CCTS 2023, enacted under the Energy Conservation Act, 2001, establishes a framework for generating, trading, and using carbon credit certificates. Drawing from Article 17 of the Kyoto Protocol, which allowed countries with spare emission units to sell them to those exceeding their targets, the CCTS enables industries to trade carbon credits on the Indian Carbon Market (ICM) platform, overseen by the Bureau of Energy Efficiency (BEE) under the Union Ministry of Power.

- Under the GEI rules, industries that reduce their emissions intensity below their targets earn carbon credits, which they can trade on the ICM. Those failing to meet targets must purchase credits to cover their shortfall or face penalties from the CPCB. This market-based mechanism incentivizes decarbonization: industries with resources to adopt clean technology can profit by selling credits, while others can transition gradually by buying credits. Similar carbon markets have operated in Europe (since 2005) and China (since 2021), showing the global relevance of such system

October 17, 2025

October 16, 2025

October 6, 2025

September 24, 2025