February 3, 2026

The 16th Finance Commission (16th FC)

The 16th Finance Commission (16th FC), chaired by Dr. Arvind Panagariya, submitted its report to President Droupadi Murmu on November 17, 2025. Tabled alongside the Union Budget 2026-27 on February 1, 2026, the recommendations define the fiscal architecture for the five-year period from April 1, 2026, to March 31, 2031.

1. Vertical Devolution: Distribution between Centre and States:

-

Retention of 41% Share: The commission recommended that the states’ share in the divisible pool of central taxes remain at 41%. This is identical to the 15th Finance Commission’s recommendation.

-

Stability in Resource Transfer: This decision aims to maintain fiscal stability despite requests from 18 states to increase the share to 50%.

-

Divisible Pool Shrinkage: The commission noted that cesses and surcharges (not shared with states) reduced the effective divisible pool from 89.1% of gross tax revenue in 2014-15 to roughly 74–80% in recent years.

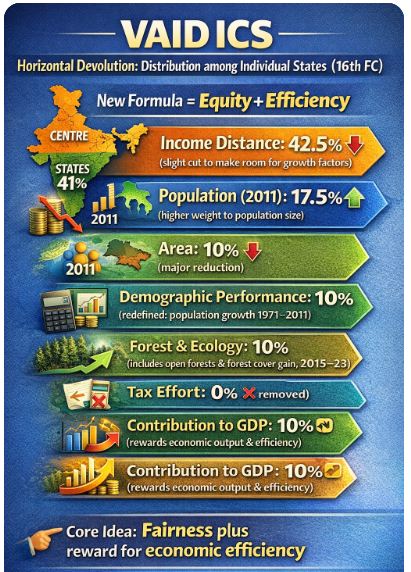

2. Horizontal Devolution: Distribution among Individual States:

The commission introduced a new formula to reward economic contribution while balancing equity:

| Criteria | 15th FC Weight | 16th FC Weight | Key Change / Impact |

| Income Distance | 45% | 42.5% | Marginal reduction to accommodate growth parameters. |

| Population (2011) | 15% | 17.5% | Increased weightage for population size. |

| Area | 15% | 10% | Significant reduction. |

| Demographic Performance | 12.5% | 10% | Redefined using population growth between 1971–2011. |

| Forest & Ecology | 10% | 10% | Now includes open forests and increase in forest cover (2015–2023). |

| Tax Effort | 2.5% | 0% | Dropped entirely in favor of broader GDP metrics. |

| Contribution to GDP | 0% | 10% | New parameter to reward economic efficiency and output. |

Winners & Losers:

-

Gainers: Coastal and industrialized states like Karnataka, Tamil Nadu, Maharashtra, Gujarat, and Andhra Pradesh saw their shares increase due to the new GDP contribution parameter.

-

Losers: Populous states like Uttar Pradesh and Bihar saw their relative shares decrease.

3. Grants-in-Aid (Total: ₹9.47 Lakh Crore):

-

Local Body Grants: Allocated ₹7.9 lakh crore, with ₹4.4 lakh crore for rural and ₹3.6 lakh crore for urban bodies.

-

Performance-Based: 20% of these grants are performance-linked, while 80% are basic.

-

Tied Components: 50% of the basic grant is tied to water management and sanitation.

-

-

Disaster Management: Recommended ₹2.04 lakh crore for State Disaster Relief and Mitigation Funds (SDRF/SDMF).

-

Discontinued Grants: The 16th FC has discontinued revenue deficit grants, sector-specific grants, and state-specific grants.

4. Fiscal Discipline and Roadmap:

-

Fiscal Deficit Targets:

-

Union: Bring down to 3.5% of GDP by 2030-31.

-

States: Cap at 3% of GSDP.

-

-

Off-Budget Borrowings: Recommended strictly discontinuing off-budget borrowings; all such debts must be brought onto official budgets for transparency.

-

Power Sector Reforms: States are encouraged to privatize electricity distribution companies (DISCOMs).

5. Public Sector & Subsidy Reforms:

-

Inactive PSEs: Recommended review and closure of 308 inactive State Public Sector Enterprises.

-

Subsidy Targeting: Suggested move away from unconditional cash transfers toward clear exclusion criteria for better targeting.

High-Value Addition for UPSC:

-

Article 280: The Finance Commission is a constitutional body that recommends tax sharing every five years.

-

Article 281: The government must lay the report along with an “Explanatory Memorandum” of action taken.

-

The “Grand Bargain”: The commission suggested folding a large part of cesses and surcharges into regular taxes in exchange for states agreeing to broader tax reforms.

October 17, 2025

October 16, 2025

October 6, 2025

September 24, 2025