February 2, 2026

UNION BUDGET 2026-27/IMPORTANT TERMS FOR UPSC PRE & MAINS

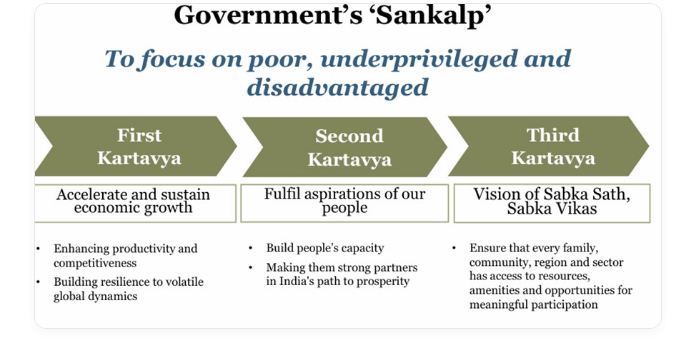

OVERALL BUDGET PHILOSOPHY (MAINS READY INTRO)

Theme:

- Fiscal discipline + High public investment + Structural reforms

- Continuity with reform momentum + focus on Viksit Bharat @2047

Key Macro Signals:

- Growth rate ~ 7% (India fastest-growing major economy).

- Fiscal deficit on glide path.

- Emphasis on “crowding-in” private investment.

- Shift from welfare-only to productive capital expenditure.

TAX REFORMS & EASE OF DOING BUSINESS (GS III + ESSAY):

Income Tax Act, 2025

- Replaces Income Tax Act, 1961 from 1 April 2026.

- Sections reduced: ~800 → ~500.

- Objective: Certainty, simplicity, litigation reduction.

- Why it matters (Mains value):

-

- Reduces “tax terrorism.”

- Improves Ease of Doing Business.

- Enhances voluntary compliance.

Individual Taxpayer Relief (Pre + Mains)

- MACT compensation interest → Fully tax exempt.

- LRS TCS reduced to 2% for education, medical, tours.

- Automated lower/nil TDS for small taxpayers.

- Revised return filing extended till 31 March.

FISCAL CONSOLIDATION & DEBT PATH (VERY IMPORTANT)

Deficit & Debt Targets::

| Indicator | Value |

| Fiscal Deficit (BE 2026-27) | 4.3% of GDP |

| Debt-GDP | 55.6% |

| Target Debt-GDP | 50±1% by 2030-31 |

UPSC Angle:

- Counter-cyclical fiscal policy.

- Long-term macroeconomic stability.

- Lower interest burden → more social & infra spending.

PUBLIC CAPEX & INFRASTRUCTURE PUSH (GS III CORE)

Capital Expenditure:

- Rs 12.2 lakh crore public capex (FY 2026-27).

- Focus: Roads, railways, ports, logistics, cities.

New Instruments:

- Infrastructure Risk Guarantee Fund → de-risking private investment.

- City Economic Regions (CERs) for Tier II/III cities.

Logistics Expansion:

- New Freight Corridors.

- 20 new National Waterways.

- Coastal cargo share target: 12% by 2047.

- Inland waterways + ship repair hubs.

MANUFACTURING & INDUSTRIAL POLICY (Make in India 2.0):

7+ Strategic Manufacturing Sectors:

- Semiconductors (ISM 2.0): Equipment + Indian IP.

- Biopharma SHAKTI: Biologics, biosimilars.

- Electronics components: Rs 40,000 cr.

- Rare Earth Corridors: Strategic minerals.

- Chemical Parks: Cluster-based.

- Capital Goods: Container manufacturing, CIE scheme.

- Textiles: National Fibre Scheme, Mega Textile Parks.

- Khadi & Sports Goods: Gram Swaraj + global branding.

Mains Linkages:

- Import substitution.

- Export competitiveness.

- Employment-intensive manufacturing.

MSMEs & LEGACY CLUSTERS (PRE + MAINS)

- Revival of 200 legacy clusters.

- SME Growth Fund: Rs 10,000 cr.

- TReDS mandatory for CPSE-MSME payments.

- Corporate Mitras: Compliance handholding.

Impact:

- Formalisation.

- Credit access.

- Productivity enhancement.

GREEN TRANSITION & ENERGY SECURITY :

Panchamrit in Action:

- Green Hydrogen Mission.

- Small Modular Reactors (SMRs) funding.

- CCUS (Carbon Capture, Utilization, and Storage): Rs 20,000 cr for steel, cement, power.

Why UPSC loves this:

- Net Zero 2070.

- Climate finance + energy transition.

- Balancing growth & sustainability.

FINANCIAL SECTOR & CAPITAL MARKETS

- Banking reforms committee for Viksit Bharat.

- Corporate bond market market-making framework.

- Municipal bonds incentive.

- MAT reduced to 14%, becomes final tax.

- Buyback tax rationalised.

- Prelims keywords: MAT, STT, Safe Harbour, Municipal Bonds.

SOCIAL SECTOR: EDUCATION, HEALTH & TOURISM

Education & Skills:

- Education → Employment linkage.

- AVGC labs in schools & colleges.

- Girls’ STEM hostels (1 per district).

Health:

- Allied Health Professionals (100,000).

- Geriatric caregivers.

- Medical tourism hubs.

- NIMHANS-2 (mental health).

Tourism:

- National Digital Knowledge Grid.

- Adventure + heritage tourism circuits.

- Experiential archaeology.

AGRICULTURE & INCLUSION (GS III)

- High-value crops focus.

- Fisheries & reservoirs.

- AI-based Bharat-VISTAAR advisory.

- Women: SHE-Marts.

- Divyangjan: Skill & assistive devices.

- Purvodaya focus: East India development.

PRELIMS-ORIENTED ONE-LINERS

- Fiscal deficit BE 2026-27: 4.3%.

- Public capex: Rs12.2 lakh crore.

- Income Tax Act, 2025 effective: 1 April 2026.

- CCUS outlay: Rs 20,000 crore.

- Debt-GDP target: 50±1% by 2030-31.

- Courier export value cap: Removed.

- MAT reduced to: 14%.

MAINS ANSWER VALUE ADD (USE THESE PHRASES)

- “Crowding-in effect of public capex”

- “Transition from consumption-led to investment-led growth”

- “Fiscal prudence with developmental orientation”

- “Structural transformation of Indian economy”

- “Green growth pathway aligned with Panchamrit”

UPSC/PCS –PRE & MAINS

IMPORTANT TERMS :

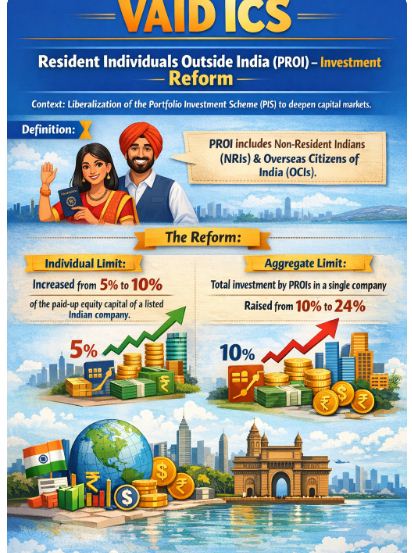

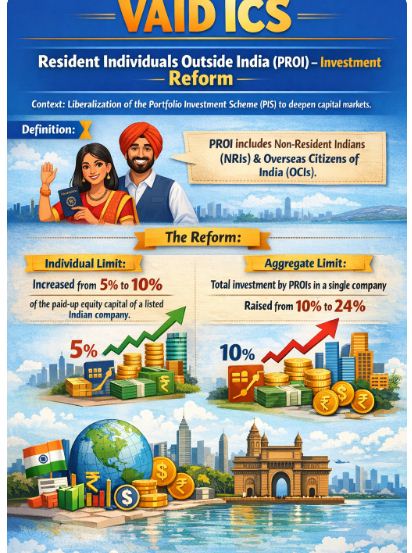

Resident Individuals Outside India (PROI) – Investment Reform:

Context: Liberalization of the Portfolio Investment Scheme (PIS) to deepen capital markets.

Definition: PROI includes Non-Resident Indians (NRIs) and Overseas Citizens of India (OCIs).

The Reform: * Individual Limit: Increased from 5% to 10% of the paid-up equity capital of a listed Indian company.Aggregate Limit: The total investment by all PROIs in a single company increased from 10% to 24%.

- Significance: Encourages stable, long-term capital inflows from the Indian diaspora and improves price discovery in the stock market.

Bharat-VISTAAR (Virtually Integrated System to Access Agricultural Resources):

Context: A flagship AI-driven digital public infrastructure for “Precision Farming.”

Mechanism: A multilingual AI tool that integrates AgriStack (digital farmer records) with ICAR’s (Indian Council of Agricultural Research) scientific “package of practices.”

Key Features:

Customized Advisory: Soil health-based crop selection, real-time weather alerts, and pest management.

Last-Mile Connectivity: Available in Hindi, English, and regional languages to bridge the information gap.Risk Reduction: Helps farmers mitigate climate-related risks through predictive analytics.

Liberalized Remittance Scheme (LRS) & TCS Rationalization:

Context: Easing the liquidity burden on middle-class families for global mobility.

- LRS Overview: Allows residents to remit up to USD 250,000 per year for travel, education, medical, or investment.

- Budget 2026 Change: * Overseas Tours: TCS slashed from a complex 5%/20% structure to a flat 2% (with no threshold).

- Education & Medical: TCS reduced from 5% to 2% for remittances exceeding Rs 10 lakh.

- Mains Value: This moves away from using high TCS as a “tax tracking” tool toward “Ease of Living,” preventing the locking up of family capital for months.

Biopharma SHAKTI:

Context: Strategy to transform India from a “Generics Hub” to a “Global Biopharma Manufacturing Hub.”

- Outlay:Rs 10,000 crore over 5 years.

- Components:

- NIPER Expansion: 3 new National Institutes of Pharmaceutical Education and Research and 7 upgrades.

Clinical Trials: A network of 1,000+ accredited sites to facilitate domestic biologics and biosimilars.

- Regulator Strengthening: Specialized scientific review cadre for CDSCO to meet global approval timelines.

Industrial & Chemical Clusters (Strategic Geography):

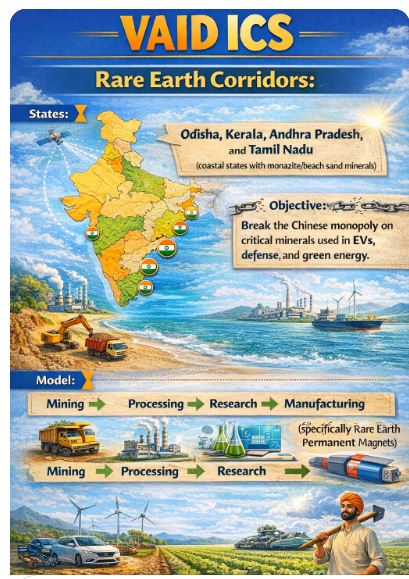

A. Rare Earth Corridors:

- States: Odisha, Kerala, Andhra Pradesh, and Tamil Nadu (coastal states with monazite/beach sand minerals).

- Objective: Break the Chinese monopoly on critical minerals used in EVs, defense, and green energy.

- Model: Integrated hubs for Mining → Processing → Research → Manufacturing (specifically Rare Earth Permanent Magnets).

B. Chemical Parks:

- Mechanism: Established via the “Challenge Route” (States compete based on ease of doing business).

- Plug-and-Play Model: Ready-to-use infrastructure (effluent plants, logistics) to reduce “Time to Market” and import dependency.

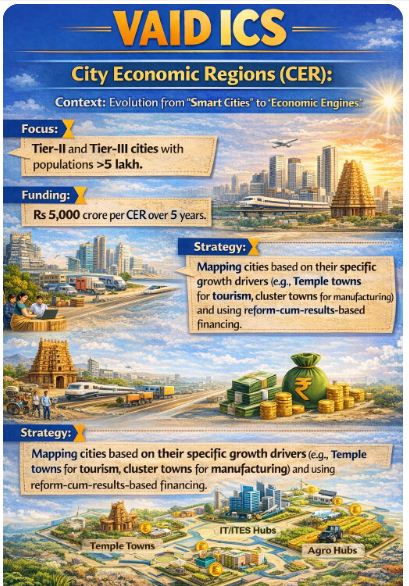

City Economic Regions (CER):

Context: Evolution from “Smart Cities” to “Economic Engines.”

- Focus: Tier-II and Tier-III cities with populations >5 lakh.

- Funding: Rs 5,000 crore per CER over 5 years.

- Strategy: Mapping cities based on their specific growth drivers (e.g., Temple towns for tourism, cluster towns for manufacturing) and using reform-cum-results-based financing.Tourism: Trails & Digital Infrastructure:

A. National Destination Digital Knowledge Grid:

- A unified digital repository to document cultural, spiritual, and historic

- Utility: Improves discoverability for tourists and provides data for evidence-based planning for local bodies.B. Specialized Trails (Experiential Tourism):

- Mountain Trails: In HP, Uttarakhand, and J&K.

- Turtle Trails: Coastal Odisha, Karnataka, and Kerala (focusing on nesting sites like Gahirmatha).

- Bird-Watching Trails: Pulicat Lake (Andhra/Tamil Nadu) and other wetlands.Infrastructure & Logistics:

A. Infrastructure Risk Guarantee Fund:

- Objective: To provide partial credit guarantees to lenders.

- Impact: De-risks the “construction phase” for private developers, encouraging private banks to lend more freely to long-gestation infra projects.B. New Dedicated Freight Corridors (DFC)

- Route: Dankuni (West Bengal) to Surat (Gujarat).

- Connectivity: Connects 6 states; links the Eastern DFC to the Western DFC.

- Significance: Enables high-speed, high-axle-load cargo movement from eastern mineral belts to western ports.

October 17, 2025

October 16, 2025

October 6, 2025

September 24, 2025