December 22, 2025

What is Private Capital Expenditure (capex)? UPSC

Why in the News? The article highlights a key economic paradox: India’s GDP is expanding robustly (around 6–7% in recent quarters), but private capital expenditure (capex) remains stagnant at ~12% of GDP for over a decade.

Key Points:

- GDP Growth vs. Private Capex Disconnect

-

- India’s GDP has grown rapidly post-COVID, but private capex (investment in machinery, plants, etc.) has been stuck at ~12% of GDP since ~2011.

- Total Gross Fixed Capital Formation (GFCF) rose to ~33.7% of GDP in FY25, but private share declined to 34.4% in FY24 (lowest since 2011–12).

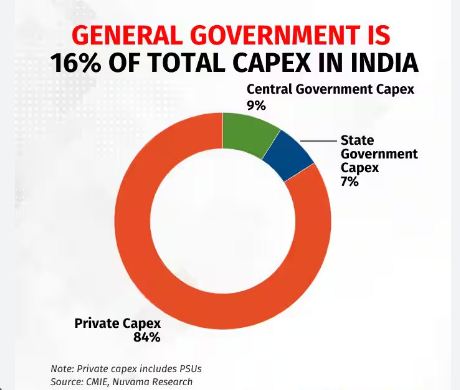

- Public capex (government + state) has driven growth, while private sector remains cautious.

Recent Data Highlights:

- Listed companies’ capex rose 11% YoY in FY25 to ~₹4 lakh crore (CareEdge Ratings).

- Gross fixed assets of ~4,500 companies grew 8.5% YoY as of September 2025 (Bank of Baroda).

- MoSPI’s private capex survey shows intentions for FY26 at ₹89 lakh crore (down 26% from FY25), though data has caveats.

- Informal sector fixed assets grew only 1.9% YoY to September 2024.

- Capacity Utilization and Demand:

-

- Manufacturing capacity utilization remains low (~75–76% in recent RBI OBICUS surveys), indicating excess capacity and no urgent need for new investments.

- Companies face weak demand, high input costs, and global uncertainties (e.g., US tariffs, trade wars).

Core Issues:

- Stagnant Private Investment

-

- Private capex has not revived despite corporate profits hitting highs and government incentives.

- Firms prefer financial investments, debt repayment, or acquisitions over new capacity.

- Over-Reliance on Public Capex

-

- Government spending has filled the gap, but private sector must lead for sustainable, job-creating growth.

- Risks: Crowding out private investment, fiscal strain if public capex slows.

- Broader Economic Risks

-

- Low private investment could cap long-term growth potential.

- Global headwinds (tariffs, geopolitical tensions) and domestic demand weakness add caution.

Way Forward:

To revive private capex, experts suggest:

- Boost Demand → Targeted fiscal measures for consumption (e.g., tax cuts, rural support) to create demand-pull for investments.

- Policy Reforms → Simplify taxes, reduce regulatory hurdles, and improve ease of doing business.

- Incentives → Extend PLI schemes, provide viability gap funding, and encourage PPPs in infrastructure.

- Monetary Support → Potential rate cuts if inflation eases, lowering borrowing costs.

- Structural Fixes → Address excess capacity, enhance credit flow to productive sectors, and channel household savings into productive investments.

What is Private Capital Expenditure (Capex)?

Private capital expenditure (private capex) refers to the spending by private sector companies (such as corporations, firms, and businesses) on acquiring, upgrading, or maintaining long-term fixed assets that are used to generate future income. These assets are typically physical and long-lasting, meant to expand production capacity or improve efficiency.

Key Components of Private Capex:

Private capex generally includes:

- Machinery and equipment (e.g., new factory machines, computers, vehicles)

- Buildings and infrastructure (e.g., new factories, warehouses, offices, hotels)

- Land improvements (e.g., construction of roads, bridges, or facilities within company premises)

- Technology and R&D-related fixed assets (e.g., specialized software, testing labs)

- Expansion or modernization of existing facilities

It does not include:

- Day-to-day operational expenses (opex) like salaries, raw materials, or utilities

- Financial investments (e.g., buying stocks or bonds)

- Short-term working capital

How Private Capex is Measured?

- Gross Fixed Capital Formation (GFCF) – the official economic measure that includes both private and public capex.

- Private capex is the private sector portion of GFCF.

- In India, it is tracked through:

-

- Ministry of Statistics and Programme Implementation (MoSPI) surveys

- RBI’s Order Books, Inventories and Capacity Utilisation Survey (OBICUS)

- Corporate balance sheets and project announcements

What is Crowding Out of Private Investment?

Crowding out refers to a situation where increased government spending or borrowing reduces (or “crowds out”) private sector investment in the economy. It happens when the government competes with private borrowers for the same pool of available funds, leading to higher interest rates or reduced access to credit for businesses.

This phenomenon is a key concept in macroeconomic theory, particularly in discussions about fiscal policy, public debt, and the balance between public and private sector activity.

How Crowding Out Works ?

Financial Crowding Out :

-

- Government borrows heavily to finance its spending (e.g., infrastructure projects, subsidies).

- This increases demand for loanable funds in the financial market.

- With limited savings available, interest rates rise.

- Higher borrowing costs make it more expensive for private companies to take loans for new projects (capex), leading them to cut back on investment.

Resource Crowding Out:

-

- Government spending absorbs labor, materials, and other resources.

- This reduces availability for private firms, driving up costs and limiting private expansion.

Psychological/Expectation Crowding Out:

-

- Large public deficits signal future tax hikes or inflation.

- Businesses become cautious and delay or reduce investments.

October 17, 2025

October 16, 2025

October 6, 2025

September 24, 2025