December 18, 2025

Sabka Bima Sabki Raksha (Amendment of Insurance Laws) Bill, 2025

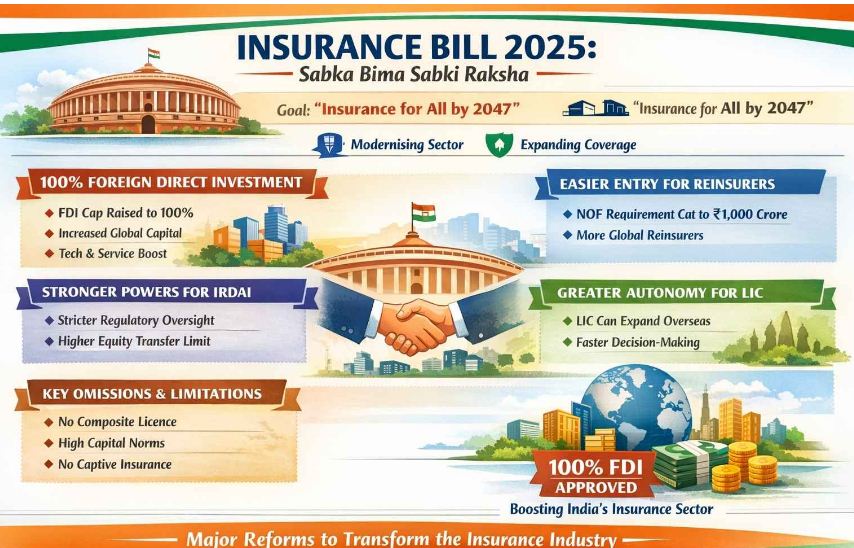

Why in News ? The Rajya Sabha passed the Sabka Bima Sabki Raksha (Amendment of Insurance Laws) Bill, 2025 on Wednesday via a voice vote. This follows the Lok Sabha’s clearance of the bill just a day prior, effectively opening the Indian insurance sector to 100% Foreign Direct Investment (FDI).

Key Legislative Changes:

The passing of this Bill triggers major amendments across three primary legislative frameworks:

-

The Insurance Act, 1938

-

The Life Insurance Corporation Act, 1956

-

The Insurance Regulatory and Development Authority Act, 1999

Objectives and Economic Impact:

Union Finance Minister Nirmala Sitharaman highlighted several benefits intended to strengthen the national economy and insurance landscape:

-

Increased Penetration: The move aims to bring insurance coverage to a larger portion of the population.

-

Lower Premiums: Enhanced competition and capital flow are expected to reduce premium costs for citizens.

-

Job Creation: The expansion of the sector is projected to create new employment opportunities.

-

Operational Independence: Foreign companies can now operate in India even if they are unable to secure a local joint venture partner.

-

Entry of Smaller Players: The requirement for net owned funds has been slashed from Rs 5,000 crore to Rs 1,000 crore, allowing smaller companies to enter the market.

Historical Context of FDI in Insurance:

The increase to 100% marks the final stage in a decade-long liberalization of the sector:

-

2015: FDI limit increased from 26% to 49%.

-

2021: FDI limit increased from 49% to 74%.

-

2025: FDI limit increased to 100%.

Opposition Concerns:

Despite its passage, the Bill faced significant pushback from opposition members:

-

Parliamentary Review: The House rejected a demand to send the Bill to a parliamentary panel for further scrutiny.

-

Linguistic Objections: Opposition members objected to the use of both Hindi and English words in the Bill’s official title.

-

Rural Market Protections: TMC’s Saket Gokhale argued that private insurers may ignore low-premium, high-risk rural markets, potentially hampering government-provided protections.

-

Predatory Pricing: Concerns were raised regarding private companies entering the market with predatory pricing, which could affect the market share and profits of LIC.

-

Policy Inconsistency: Congress MP Shaktisinh Gohil noted that past BJP leaders and the party’s 2014 manifesto had previously opposed allowing FDI in the insurance sector.

About the Insurance Act, 1938:

The “Parent” Law This is the original, comprehensive legislation created during British rule to regulate the insurance business in India.

-

Purpose: It was designed to bring all types of insurance (Life and General) under a single regulatory system to prevent fraud and protect policyholders from “fly-by-night” operators.

-

Key Features: * Mandated the compulsory registration of all insurance companies.

-

Set rules for how companies could invest their funds (ensuring they kept enough money to pay claims).

-

Established the position of the Controller of Insurance, the very first insurance regulator in India.

-

About the Life Insurance Corporation (LIC) Act, 1956:

The “Nationalization” Law In the 1950s, the Indian government decided that life insurance was too important for the private sector alone and should be used to fund national development.

-

Purpose: This Act nationalized the life insurance industry by merging 245 Indian and foreign insurers into one single entity: the Life Insurance Corporation of India (LIC).

-

Key Features:

- Gave LIC the exclusive right (monopoly) to carry out life insurance business in India.

- Provided a Sovereign Guarantee, meaning the Government of India would be responsible for paying policyholders if LIC ever failed.

- Mandated that LIC invest heavily in government-approved projects like housing, water supply, and infrastructure.

About the IRDA Act, 1999:

The “Liberalization” Law By the late 90s, the government realized that a monopoly was slowing down growth and innovation. This Act reopened the door to the private sector.

-

Purpose: It established the Insurance Regulatory and Development Authority (IRDA) as an independent, statutory body to oversee and develop the industry.

-

Key Features:

- Ended the monopoly of LIC (Life) and GIC (General), allowing private companies to enter the market again.

- Introduced Foreign Direct Investment (FDI) to bring in global capital and expertise.

- Gave the IRDA the power to issue licenses, set code-of-conduct rules for agents, and protect policyholder interests through a Grievance Redressal system.

October 17, 2025

October 16, 2025

October 6, 2025

September 24, 2025